QuickBooks vs Xero 2024: Which is Best for Small Business in 2024?

Customer service is evaluated based on the number of communication channels available, such as phone, live chat, and email. Software providers also receive points based on other resources available, such as self-help articles and user communities. Finally, they are awarded points based on the ease with which users will find assistance from independent bookkeepers with expertise in the platform. QuickBooks Online came out on top for features, ease of use, customer support but Xero wins in pricing.

Pricing Plans

- You can enjoy project conversations, file sharing and project due dates, but these features are most helpful for individual or small-team projects.

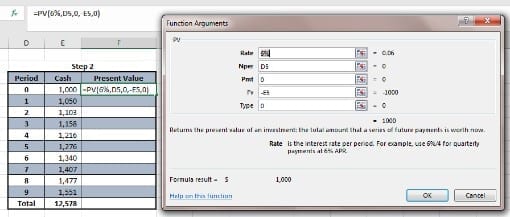

- By syncing your financial data directly into spreadsheets, you can unlock even more powerful reporting and analysis capabilities.

- First launched in 2001³, QuickBooks Online is a cloud-based accounting service from Intuit with a monthly subscription plan.

Intuit also offers QuickBooks Desktop versions for companies that require it, but in this guide, we will compare the Online version. Ironically, we don’t recommend this plan to freelancers due to its lack of tools, even though we do recommend QuickBooks as the best accounting software for the self-employed. Whether Xero profitability index pi rule definition or QuickBooks Online is right for you depends on the specific features you need and how much you can afford to pay. Xero is more affordable than QuickBooks Online, allows you to add an unlimited number of users without additional costs, and offers inventory management and fixed asset accounting in all its plans.

Price and Plans

QuickBooks has long been the gold standard among small business accounting platforms. Although it’s not the only accounting software we recommend, it’s a great choice for any small business. Its prices are competitive, especially if you use QuickBooks Self-Employed. Plus, as your business grows, upgrading you may pay tax on fd interest income at accrual stage or when bank pays up to the next pricing tier is easy. Every service plan includes all the tools your business needs to oversee its finances from the desktop or via the powerful QuickBooks mobile app. Service or project-based businesses should choose accounting software that can track project costs, revenues, and profits.

Supported Languages

Xero’s Early plan, recommended for self-employed people or brand-new businesses, allows 20 invoices per year. If you only send out an invoice or two each month, the Early plan is an affordable option at $15 per month. Otherwise, you’ll have to bump up your subscription or consider QuickBooks Online plans. If you’re in the market for accounting software, you might be feeling overwhelmed by all the options out there.

Pros and Cons of Xero vs QuickBooks Online

While Xero is easier to set up, QuickBooks has a more intuitive and customizable dashboard and has time-saving features. For instance, QuickBooks Online allows you to add an inventory item from the invoicing screen, something you can’t do with Xero. They’ll help you reconcile your bank and credit card statements and prepare monthly reports. For instance, If you have complex bookkeeping needs and require a QuickBooks-specific virtual bookkeeping service, then choose QuickBooks Live.

Core Features

If you have a microbusiness and only need to manage and track a few bills and invoices, then you might do well with Xero’s Early plan. However, if you work with multiple vendors and customers and need more enhanced features, you should consider QuickBooks Online’s Plus tier. With a free plan and paid plans starting at $20 per month, Zoho Books has plans for most budgets.

We researched both tools extensively to help you choose the right accounting software for your business. In this article, we compare their core features, pricing and pros and cons to help you decide which one is the right accounting software for your company. QuickBooks Online is a cloud-based invoicing and accounting software for small businesses and their accountants, bookkeepers, or small business owners, with a fast-growing worldwide user base. Intuit, a U.S.-based company that also makes TurboTax, owns QuickBooks. Both Bill.com and Melio are reliable accounts payable automation software options. Bill.com enhances financial efficiency for small and midsized businesses by facilitating invoice sending, bill payments, and expense management.

QuickBooks and Xero are both solutions with great tools for core accounting needs like bookkeeping, account receivable tracking, and payroll functionality at an additional cost. For those who like everything in neat compartments, Xero may be your best option. Instead of the “add what you need” process many other accounting software applications employ, Xero requires you to set up your business completely before you can start using the software. You can use QuickBooks to run roughly two dozen prebuilt accounting reports, whether using the mobile or desktop QuickBooks version. Additionally, with QuickBooks Plus and Advanced, you can create custom reports.

FreshBooks is a freelancer’s dream accounting software, as it comes with unlimited invoicing, estimates and time tracking. You can even set up recurring invoices each month, late payment reminders and scheduled late fees for overdue invoices. For tracking your expenses, FreshBooks’ base plan comes with mobile receipt scanning and bill line item capture.

We are driven by the Fit Small Business mission to provide you with the best answers to your small business questions—allowing you to choose the right accounting solution for your needs. Our meticulous evaluation process makes us a trustworthy source for accounting software insights. We don’t just scratch the surface; we immerse ourselves in every platform we review by exploring the features down to the finest nuances.

All of these things can cause extreme frustration, and you’ll need the assistance of product support to solve these problems. To make the decision a little easier, we’re comparing Xero and QuickBooks Online, side by side based on features, pricing, ease of use, and more. QuickBooks is highly user-friendly, so even if you’re not yet familiar with accounting basics, your learning curve shouldn’t be too steep. QuickBooks’ pricing plans are as follows, with a 30-day trial available for all tiers.

The Time app is available on the Essentials plan and above, while the Projects app is available for Plus users. QuickBooks limits the number of users on all of its plans, while Xero allows for unlimited users. Through Xero, you can integrate with HR software provider Gusto for $40 per month plus $6 per employee.

QuickBooks also allows you to accept payments from debit or credit cards, as well as ACH payments, Apple Pay, PayPal and Venmo. QuickBooks also includes impressive unique accounting tools, including adding outstanding balance amounts to client payment reminders. You can also automatically record and match customer payments, accept tips via invoices, and split estimates into several invoices. We like that the latter feature, which isn’t common in accounting software, boosts cash flow for businesses operating on estimates.

Melio is ideal for nonprofits, contractors, freelancers, and SMBs, offering robust management of business payments for clients. QuickBooks offers advanced invoicing features such as customization, recurring invoices, email sending, and payment options. Users can add customer information, choose payment methods, know your mexican peso add service details, and send invoices via WhatsApp or a link after saving them. It helps small and medium-sized enterprises keep track of their finances and manage their income and expenses. It can be used to keep track of financial transactions, handle invoices, pay bills, create reports, and file taxes.

Compared to QuickBooks, Xero’s time tracking features are easy to use. You can simply download the free Xero Projects app on iOS and Android, using it to record time and costs, as well as seamlessly and automatically feed the data into invoices and reports. Xero also offers mobile receipt capture through its Xero Me mobile app (previously called the Xero Expenses app), though you’ll need to upgrade to the Established plan to claim expenses. QuickBooks can also track your mileage reliably and automatically using a GPS-enabled smartphone app. Xero is also ideal if you’re seeking accounting software that grows with you.