A look at Berkshire Hathaway’s response to cellular house trap’ data

Financing

More twelve Clayton users described a frequent variety of deceptive means you to closed her or him on ruinous revenue: mortgage conditions you to altered instantly when they paid down deposits otherwise prepared land for their the newest home; wonder costs added to money; and stress to look at way too much money considering not true pledges that they you will definitely later on refinance.

The individuals fund averaged seven fee circumstances greater than the typical house financing in the 2013, centered on a middle having Societal Ethics/Times data out-of federal study, compared to simply 3.8 payment activities significantly more than for other lenders.

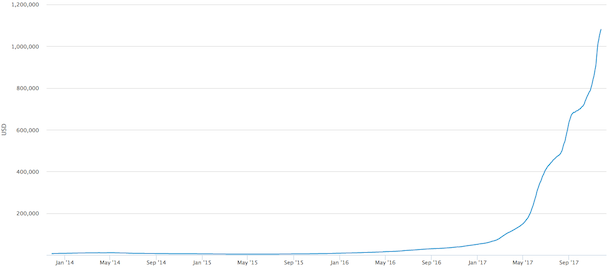

People told from Clayton range agencies urging these to scale back on the food and health care otherwise search handouts to create house costs. Of course, if home got hauled out to getting resold, specific customers currently had paid down such from inside the costs and you will desire your business however appeared ahead. Also from Great Market meltdown and you can houses  drama, Clayton was profitable annually, creating $558 billion when you look at the pre-tax money a year ago.

drama, Clayton was profitable annually, creating $558 billion when you look at the pre-tax money a year ago.

Less than government direction, very Clayton finance are thought higher-listed

Clayton’s ideas contrast that have Buffett’s personal profile as an economic sage exactly who viewpoints in control credit and you can enabling worst Us americans remain their homes.

Berkshire Hathaway spokeswoman Carrie Sova and you can Clayton spokeswoman Audrey Saunders forgotten more than 12 desires from the mobile, email address plus individual explore Clayton’s policies and you can therapy of people. During the an enthusiastic emailed declaration, Saunders told you Clayton support people get a hold of home within finances and you can enjoys a good purpose of starting doors so you can a better life, that family simultaneously.

(Update: After publication, Berkshire Hathaway’s Omaha headquarters sent an announcement with respect to Clayton Residential property into Omaha World-Herald, and that is belonging to Berkshire. The newest declaration and you may a closer look at Clayton’s claims can be receive right here.)

Billionaire individual Warren Buffett retains an ice cream pub from Berkshire Hathaway part Whole milk King as he talks to Kevin Clayton, Ceo of Clayton House, together with an effective Berkshire subsidiary, in Omaha, Nebraska, in advance of an excellent shareholders meeting within the . Nati Harnik/AP

Because Buffett informs they, his purchase of Clayton Residential property originated in an impractical origin: Going to pupils on the University out-of Tennessee offered your a duplicate from creator Jim Clayton’s notice-blogged memoir, First an aspiration, in early 2003. Buffett liked understanding the ebook and you will respected Jim Clayton’s list, he’s told you, and very quickly titled President Kevin Clayton, offering to invest in the business.

A few calls later, we’d a great deal, Buffett said at the his 2003 investors conference, based on cards drawn in the meeting of the hedge money director Whitney Tilson.

The brand new facts away from serendipitous package-and make shows Buffett additionally the Claytons while the discussing off-to-world opinions, aversion to possess Wall surface Street and you may a vintage-fashioned religion in treating some one pretty. But, indeed, the man who introduced the young so you can Omaha told you Clayton’s guide was not the fresh new genesis of bargain.

Brand new Claytons very initiated which get in touch with, told you Al Auxier, the latest UT teacher, as the retired, who chaperoned new college student journey once fostering a relationship to your billionaire.

Chief executive officer Kevin Clayton, the fresh founder’s guy, attained out to Buffett as a consequence of Auxier, the fresh new teacher told you from inside the a current interviews which winter season, and you will questioned whether Buffett might speak about a corporate dating which have Clayton Property.

At that time, cellular home loans got defaulting at shocking cost, and you can dealers had sex cautious with them. Clayton’s winnings depended towards the its ability to bundle money and you can resell these to dealers.

This is exactly why Kevin Clayton is looking to a separate supply of bucks to help you relend so you’re able to homebuyers. He realized you to Berkshire Hathaway, using its prime thread get, you can expect to promote it cheaply just like the someone. Later one to year, Berkshire Hathaway paid off $1.seven million during the bucks to purchase Clayton Residential property.